This post is also available in: Deutsch

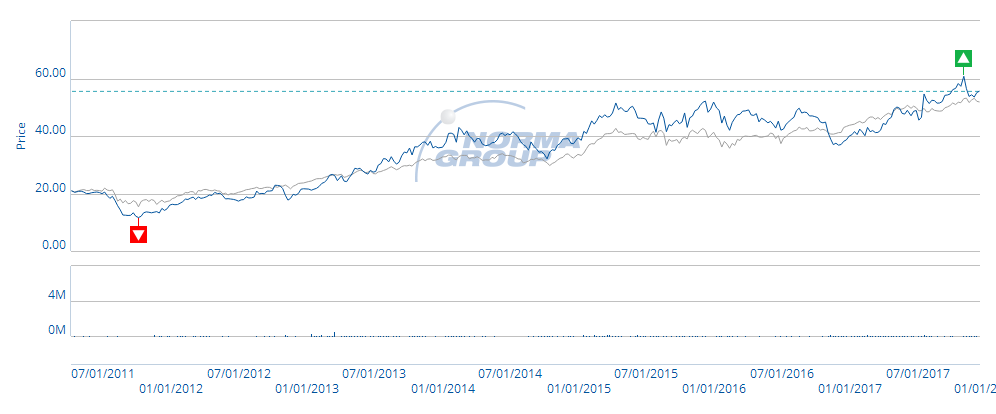

Shortly after 9 in the morning on April 8, 2011, Chairman of the Management Board Werner Deggim rang the opening bell at the Frankfurt Stock Exchange. Together with his fellow board members Bernd Kleinhens and John Stephenson, he symbolically announced the start of trading for the NORMA Group share.

The IPO, or Initial Public Offering, was a success. But what impact does being “listed” actually have on a company?

One of the key benefits is that NORMA Group has the ability to raise capital from stock market investors, which it can then use to invest in further growth, such as acquisitions.

NORMA Group’s total of around 31.86 million no-par value shares are currently 100 percent in free float. This means that the shares can be bought and sold on the stock exchange at any time.

From SDAX to MDAX

Around 95 percent of NORMA Group shares are currently held by institutional investors such as banks or investment funds. Many of these investors are based in the UK, US, Germany, France and Scandinavia. Around 2.5 percent of NORMA Group shares are currently held by private shareholders (as of June 30, 2017).

Listed companies are also subject to many legal regulations, however, partly determined by European legislation and partly by German law.

NORMA Group’s listing in the “Prime Standard” is also the segment with the highest transparency standards in the Frankfurt Stock Exchange.

The Prime Standard requires member companies to report quarterly on their business, financial, asset and earnings performances, to publish this all in German and English, to apply international accounting standards and to have at least one analyst conference per year, among other requirements.

These information sources let investors better understand NORMA Group, aiding possible investment decisions. Listing also brings about certain other requirements and obligations for a company.

Listing in the Prime Standard enabled NORMA Group to move up into the SDAX stock index and later into the MDAX. Membership in the Prime Standard is a prerequisite to joining these indices. Joining works as follows: Deutsche Börse regularly looks at all listed German companies for two decisive criteria:

1.) Average trading volume. This is the value of shares traded on the stock market over a certain period of time, and is a measure of a share’s liquidity. Share liquidity is particularly important to investors because they want to be able to buy or sell shares at any time.

2.) Market capitalization of free float. This is the number of all company shares in free float multiplied by the current share price and results in the company’s market value. NORMA Group’s is currently around EUR 1.7 billion.

Transparent Information for Investors

A company’s future prospects are most decisive for an investment decision – along with the fact that it keeps its promises. This is the only way NORMA Group can establish lasting trust among its investors.

The 30 largest German listed companies by market capitalization and trading volume form the German stock index DAX. The 50 next larger companies form the mid-cap DAX, or MDAX. And the next 50 largest companies form the small-cap DAX, or SDAX.

NORMA Group joined the SDAX in June 2011 and has been part of the MDAX since March 2013. Membership in these indices makes a stock more interesting to analysts and investors.

Since a Prime Standard listing is needed for inclusion in one of these indices, investors can trust that the highly transparent information they need to make their investment decisions is available.

Membership of an index has another advantage: there are certain equity funds that map indices such as the MDAX and buy the shares of listed companies. This in turn increases the demand for shares, often leading to higher trading volumes, higher share prices and higher market capitalization. This is yet another benefit of being listed in an index: a positive snowball effect.

NORMA Group’s shares are attractive to many investors – not only because they are listed in the MDAX, but also because of the company’s long-term history of growth and profitable margins. This gives NORMA Group strong prospects for the future – on the stock exchange and beyond.

2 responses to “The Rise at the Stock Exchange”

Rick

To whom it may correspond,

How can a NORMA employee buy stocks from the company?

Sincerely,

Rick

Andreas Runkel NORMA Group

Hello Rick, there is no special way for NORMA Group employees to buy company stocks. You may use the service of an (Online-)Broker or of an international bank to buy NORMA Group stocks.